OSSC Accountant Salary 2024 | Odisha Monthly Payment, In Hand Amount

.jpg)

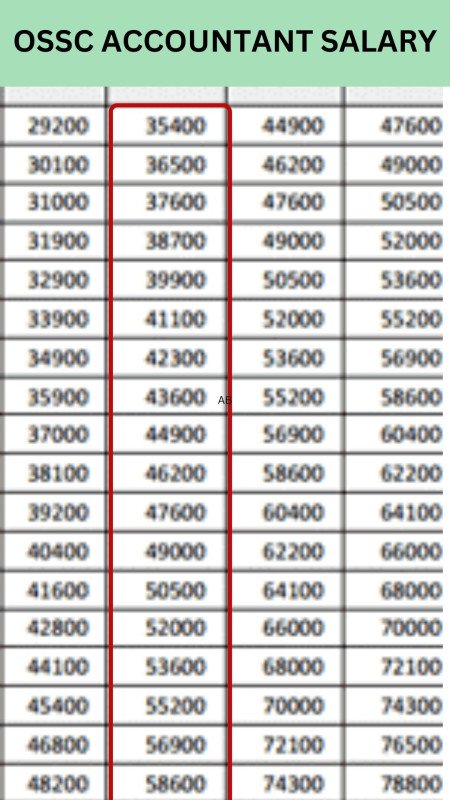

The salary package offered to OSSC Accountants is influenced by several factors, including their specialization, position, and the pay matrix established by the Odisha Government in line with the seventh pay commission. The annual salary is calculated by multiplying the monthly pay by 12. OSSC Accountants enjoy a diverse salary structure, with their monthly earnings ranging from a minimum of Rs. 35,400 to a maximum of Rs. 1,12,400. Besides the basic salary, Accountants are entitled to various allowances such as Dearness Allowance (DA) and House Rent Allowance (HRA). These allowances are calculated as a percentage of the basic pay and play a significant role in determining the overall salary package provided to OSSC Accountants.

OSSC Accountant Salary 2023

.jpg)

The Accountant position in the OSSC (Odisha Staff Selection Commission) falls under Pay Level 09 with a Pay Band of PB-1 (9300-34800) and a Grade Pay of 4200. The Pay Scale for this position ranges from Rs. 35,400/- to Rs. 1,12,400/-. The Basic Salary for an Accountant in this level is Rs. 35,400/-. In addition to the Basic Salary, an Accountant receives certain allowances and benefits. The Dearness Allowance (DA) is provided at the rate of 46% of the Basic Pay, amounting to Rs. 14,868/-. The House Rent Allowance (HRA) is 27% of the Basic Pay, which totals Rs. 9,558/-. Further deductions from the salary include Provident Fund (PF) at Rs. 5,026 and the National Pension System (NPS) contribution of Rs. 4,248. Considering the above components, the total Gross Salary for an Accountant in this position is Rs. 59,826/-. However, after the deductions, the Total Deduction amounts to Rs. 9,274/-. Hence, the In-Hand Amount that an Accountant can expect to receive per month is approximately Rs. 50,552/-. Please note that these figures are subject to change as per government rules and regulations.

| OSSC Accountant Salary ⬇ | |

|---|---|

| OSSC Accountant | AMOUNT |

| Pay Level | 09 |

| Pay Band | PB-1(9300-34800) |

| Grade Pay | 4200 |

| Pay Scale | Rs. 35,400/ – 1,12,400/ |

| Basic Salary | Rs.35,400/- |

| Maximum Salary | Rs.1,12,400/- |

| Dearness Allowance (DA) | Rs.14868/- (46% Of Basic Pay) |

| House Rent Allowance (HRA) | Rs.9558/- (27% Of Basic Pay) |

| PF | Rs.5026 |

| NPS | Rs.4248 |

| Total Gross Salary | Rs.59826 |

| Total Deduction | Rs.9274 |

| In Hand Amount | Rs.50552/- (Approx Per Month) |

OSSC Accountant Salary Allowances

Here is a summary of the salary details for OSSC Accountants (PRT)s, including their daily, monthly, and annual income. Please note that these figures represent the in-hand salary of the constables and do not include any allowances or deductions.

| OSSC SALARY ALLOWANCES ⬇ | |

|---|---|

| ALLOWANCES | AMOUNT |

| DA | ✅ Yes (46% Of Basic Pay) |

| HRA | ✅ Yes (8%-27% Of Basic) |

| TA | ✅ Yes Rs.1000 – 1500/- |

| TA on Retirement | ✅ Yes |

| Medical Allowance/CGHS facilities. | ✅ Yes |

| Air travel facilities | ✅ Yes |

| Special Duty Allowance (SDA) | ✅ Yes |

| Food Allowance | ✅ Yes |

| Extra time work | ✅ Yes |

| Special compensatory | ✅ Yes |

| Retired pension | ✅ Yes |

| Uniform Allowance | ✅ Yes |

| Diwali Bonus | ✅ Yes |

| Family pension | ✅ Yes |

| Insurance Cover | ✅ Yes |

| ☛ Sarkari Exam | |

OSSC Accountant Salary Deductions Details

The state government deducts a portion of the salaries of our front-line government employees to ensure their bright futures. These deductions are Rs 100 per month for insurance coverage, 10% of basic for NPS, and 12% of basic for PF.

| OSSC PRT SALARY DEDUCTIONS ⬇ | |

|---|---|

| DEDUCTIONS | AMOUNT |

| NPS | ✅ Yes, Rs.5026/- (10% Of Basic Pay and DA) |

| PF | ✅ Yes, Rs.4248/- (12% Of Basic Pay) |

| Income Tax | ✅ Yes, Applicable |

OSSC Accountant Salary After 7th Pay Commission

As per the 7th Pay Commission, the OSSC Accountant is placed in Pay Grade 6 with a graded salary of 4200. The pay scale is set at 5200–2200. All allowances and deductions are implemented in accordance with the Odisha matrix rules.

.jpg)

OSSC Accountant Salary 2023 FAQs

⭐What is the Pay Level and Pay Band for the OSSC Accountant position?The OSSC Accountant position falls under Pay Level 09 and is categorized under Pay Band PB-1, which ranges from Rs. 9300 to Rs. 34800.

⭐What is the Grade Pay for the OSSC Accountant position?The Grade Pay for the OSSC Accountant position is Rs. 4200.

⭐What is the Pay Scale for the OSSC Accountant position?The Pay Scale for the OSSC Accountant position ranges from Rs. 35,400/- to Rs. 1,12,400/-.

⭐What is the Basic Salary for an OSSC Accountant?The Basic Salary for an OSSC Accountant is Rs. 35,400/-.

⭐What allowances are provided along with the Basic Salary for an OSSC Accountant?An OSSC Accountant receives Dearness Allowance (DA) at 46% of the Basic Pay, amounting to Rs. 14,868/-. Additionally, House Rent Allowance (HRA) is provided at 27% of the Basic Pay, which totals Rs. 9,558/-.

⭐What is the Total Gross Salary for an OSSC Accountant?The Total Gross Salary for an OSSC Accountant is Rs. 59,826/-.

⭐What is the Total Deduction from an OSSC Accountant's salary?The Total Deduction from an OSSC Accountant's salary is Rs. 9,274/-.

Comments-

Sarkari Naukri Exams-

Thanks for visiting us!

If you have any question please add a comment.

We will reply within 24 Hours.

Thanks & Regards!

Sarkari Naukri Exams.

Updated:

Highlights

Advertisements

Comment